;)

October 22, 2019

Why Tyrrells

Reasons for using NSW’s only ISO accredited Building Consultancy

;)

December 8, 2019

The Basic RULES of Waterproofing : Part 1

Waterproofing mistakes are arguably the most costly to everyone. Jerry Tyrrell provides the third in a series of articles that translate the National

;)

December 9, 2019

The Rules of Waterproofing: part 2

WATERPROOFING RULES: PART 1 looked at the main principles of waterproofing we all should know or be able to find quickly. This second part by Jerry Tyrrell delves further into the detail

;)

April 7, 2023

House Hunting By Jerry Tyrrell

If buying a home is one of the most important financial and emotional decisions we make, it is also the classic case of caveat emptor – let...

;)

April 7, 2023

The Pest Pack By Jerry Tyrrell

Since the ’50s we’ve been brainwashed about termites and other serious pests of timber in our buildings. If we find termites, we assume the...

;)

December 13, 2019

A Translation of the NCC

In mid-September Jerry presented a paper at the ABCB’s Building Australia’s Future Conference.

;)

December 10, 2019

The Best Way to Build is to Build Properly

I’ve been watching our industry for nearly 50 years. Mistakes cost us a fortune every year. I reckon we waste over $5b on rectification or maintenance work we don’t like doing.

;)

November 1, 2019

The Typical Auction

If you are planning to buy at auction thorough preparation for each purchase is essential. If you plan to bid you must do all the research before the auction day.

;)

December 15, 2019

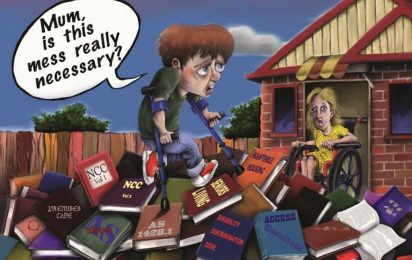

Walking the Walk – Access RULES: Part 1

The RULES project that Connection Magazines and I are preparing is intended in part as a valid alternative to the sometimes confusing and expensive Australian Standards.

;)

December 16, 2019

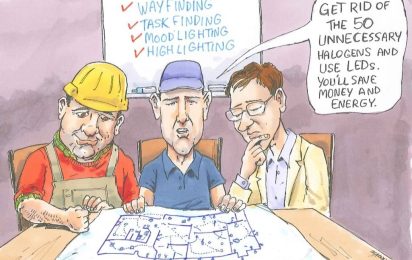

Let There Be Light

Lighting is an important part of the homeand serves both an aesthetic and practical purpose. While lighting design is usually the

;)

April 4, 2016

Instances of a dilapidation report

Consultants assess and report on the condition of buildings and quality of building work. In practice, this requires objectivity,

;)

December 12, 2019

The Secrets of Beautiful Buildings

Builders have shaped everything beautiful in the civilised world. We need to make sure that our work is treasured and

;)

October 18, 2019

A guide for a trouble-free building

Tens of thousands of building projects go wrong every year. Most of the trouble starts from a combination of errors and omissions in the plans,

;)

October 4, 2019

Off the Plan Purchase

A popular way to buy a new unit, townhouse or strata commercial property is to purchase it before building work is even started.

;)

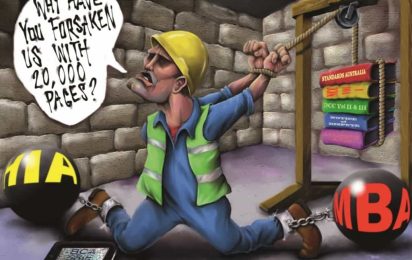

September 28, 2018

The anatomy of building

Builders are working hard to build well but there are so many groups gouging and obstructing what they do.

;)

June 2, 2016

DIY inspections – A good idea or not?

It’s tempting to think that with some sort of checklist you can do a pre-purchase inspection on a property yourself. STOP and reconsider! Yes, in the short-term

;)

May 26, 2016

Top 10 Tips When Buying Pre-purchase Reports

This is the transcript of a recent interview between Stephen Ransley, General Manager of Tyrrells Property Inspections, and Lisa Tremolada from Maddisons Real Estate

;)

May 2, 2016

Keeping Fire Stairs Safe

Fire isolated stairs are constructed mainly for use in emergencies. The Building Code of Australia (BCA) Performance Requirement DP2 requires all

;)

April 5, 2016

Hot property: Building in bushfire areas

Are you considering developing your land or buying a property close to bushland, open fields or even wet lands? If so, do you know what level of bushfire protection your development will need

;)

March 21, 2016

The Truth About Termites

Termites are a concern in the Australian building industry, but separating popular beliefs from hard facts can sometimes be diffi cult.

;)

August 13, 2015

Clearing Away the Smoke

In my three articles on the Building Code of Australia (winter, spring, and summer 2006) I mentioned how it handles fire safety.

;)

July 17, 2013

Looking for an architect?

can provide you with quality design advice, and prepare all your documentation for approval and construction.

;)

July 16, 2013

Building below ground level…Keeping dry

Some building work is more complex than others, and the more complex it is the more costly the mistakes. Building below ground level throws up more technical problems than you may think.

;)

May 1, 2013

As easy as ABC?

Every year thousands of home owners take on the task of renovating their homes. Sometimes they do it as owner-builders/home renovators and sometimes they engage a licensed builder.

;)

April 23, 2013

Doing the right thing by your clients

Building contractors have a very special place in most clients’ hearts. Builders can be the ‘keepers’ of so many good things. If you do the right thing by your clients,

;)

April 23, 2013

Fire Safety Measures – The burning issue

Incorporating fire safety measures into a renovation or new build is essential in order to safeguard against the potential threat of a house fire or bushfire.

;)

October 8, 2012

Tyrrells Plans & Approvals wins Two Building Design Awards

On 31 August 2012 at the BDA (Building Designers Association) Design Awards 2012, Tyrrells Plans & Approvals received commendations in the categories of ‘Commercial Alterations & Additions’ and ‘Non-residential Interiors’ for their work on The Salvation Army project in Auburn.

;)

September 7, 2012

Tyrrells turns 80,000

We’ve come a long way since Tyrrells co-founder Peter Ellis carried out Australia’s first ever pre-purchase inspection in 1976

;)

June 16, 2010

The Firm

A Tyrrells promotional video from the early ’90s.

;)

June 6, 2006

A Chimney Piece

During a Pre-Purchase Inspection it is not practical to test how well a chimney “draws” the smoke from the fireplace but some rules of thumb include

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)

;)